John Endres and Anlu Keeve

With opinion polls pointing to a historic decline in support for the governing African National Congress (ANC), the post-election option space is more complex than ever. It provides a far greater number of options than has been reflected in most analysis published to date.

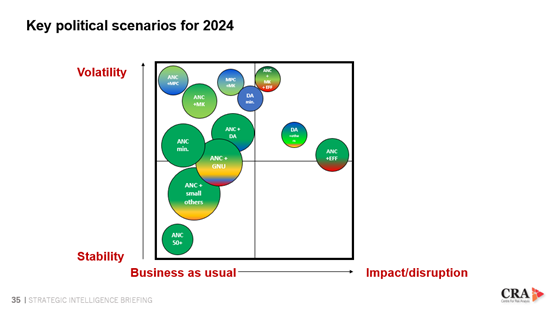

To help navigate that complexity, the IRR has developed 12 scenarios and an impact/volatility matrix that contextualises them.

In all elections since 1994, it has never been in doubt that the ANC would win a majority of the votes. Thus it was certain that South Africa would have an ANC government and that its policies and actions would shape South Africa’s outcomes. For reference, in the last national election in 2019, the ANC obtained 57.5% of the national vote, with 66% of registered voters participating in the election.

An ANC majority government is now no longer a certainty. With less than a week to go until the elections, the Social Research Foundation’s (SRF) daily tracking poll shows support for the ANC at below 50% and trending down. A below-50 result accords with surveys conducted by other polling companies in prior weeks and months. But even so, a majority is still within reach for the party. With a small increase in support in the final days, a bit of help from the margin of error in the polling, and low voter turnout, it could still scrape across the magic 50% line.

So – what should the South African public expect? In anticipation of the elections we explore 12 key election scenarios. These scenarios are plotted on a matrix that considers the volatility and disruption of the outcomes on South Africa’s policy and business environments.

Scenarios placed on the left-hand side of the matrix will result in policy continuity or business as usual. Scenarios placed towards the right-hand side will result in high impact or disruption: reforms, changes of direction, or a radical intensification of existing policies that changes the status quo.

On the vertical axis, scenarios placed at the bottom reflect stable governments that last a full five-year term. Scenarios placed towards the top indicate volatility and a higher likelihood that a government will not last a full five-year term, for instance because a coalition collapses, a vote of no confidence is called or parliament votes to dissolve itself, triggering an early election.

Scenarios are represented by circles, where the size of each circle reflects the probability of the scenario, with larger circles indicating higher likelihood. The scenarios are discussed in order of probability, from most to least likely.

Scenario 1: ANC + small others

In this scenario, the ANC garners between 45% and 49% of the vote and forms a coalition with one or more smaller parties such as the Patriotic Alliance, GOOD (the leader of which, Patricia de Lille, has already been serving in the ANC government, making it likely option), Al Jama-ah, Inkatha Freedom Party (IFP), or others.

This arrangement would bring relative stability and largely business as usual in terms of policy, as smaller parties are relatively easy to accommodate and are unlikely to force the ANC to alter its policy direction significantly. Policy differences between the ANC and these smaller parties are generally not great. This scenario is therefore likely to have minimal impact on markets and the currency, ensuring business as usual. Economically, there is likely to be very little change, with supply chain issues persisting, growth hovering around 1% to 1.5%, and minor volatility in the Rand.

Scenario 2: ANC + GNU (“government of national unity”)

Here, the ANC drops significantly below 50%. Rather than picking a partner from a range of unpalatable coalition options, it extends a broad invitation to political opposition parties in general to join it in salvaging the country. The GNU agreement would allow power-sharing and would keep the GNU parties tied up in committees and talks. While likely reducing the efficiency of the state, this arrangement would prolong the ANC’s involvement in governance over several years, buying it time. This scenario is marked by medium volatility and policy continuity, with some policy shifts possible as different parties bring their influence to bear.

Scenario 3: ANC-DA (“grand coalition”)

In this scenario, the ANC wins less than 45% of the vote and decides to strike a deal with the DA, which has been the official opposition for 25 years. There would be significant pressure on the ANC and DA to collaborate, especially from the business sector. Such a coalition holds substantial potential for conflict on policy questions such as race-based labour and procurement policies, property rights, law enforcement and anti-corruption measures, and international relations. Given the ideological differences between the two parties, a highly volatile political environment should be expected. There is a slight potential for higher economic growth, but it would likely not be sufficient to reduce unemployment meaningfully and this coalition might not last a full five years.

Scenario 4: ANC minority government

In this scenario, the National Assembly would elect an ANC MP as president, with some opposition MPs voting with ANC MPs to do so. The president would then, as is his prerogative, form a government by bringing ANC MPs into the cabinet. This ANC minority government would have to seek support from smaller parties to pass budgets and legislation. Such a scenario is likely to lead to moderate volatility and mostly business-as-usual policies. However, the process of making laws would become fraught with delays and uncertain outcomes, and the government would have little protection against votes of no confidence. The stability of such a government could be enhanced through a confidence-and-supply arrangement, where an opposition party such as the DA would agree not to support votes of no confidence in the president, as well as undertaking to supply the votes necessary to pass budgets.

Scenario 5: ANC-MK

An alliance between the ANC and MK would generate significant internal tensions and policy uncertainty as the former president, Jacob Zuma, would be keen to assert his influence within the ANC. There would likely be minimal policy impact as the parties have considerable common ground on the policy front. However, a fierce battle for resources, positions and patronage is likely to emerge, leading to high volatility and conflict.

Scenario 6: ANC-EFF

In a scenario where the ANC secures around 40%-45% of the vote it could choose to turn to the EFF for a coalition to secure a majority in the NA. However, the EFF would demand a high price for its contribution, including key leadership positions in the new government. EFF leader Julius Malema has already indicated that he would insist on Floyd Shivambu as finance minister. That could be a price too high for the ANC to consider.

In an ANC-EFF alliance, the EFF would command some cabinet positions and likely push the ANC further left on the political spectrum by prioritising policies like make-work schemes at state-owned enterprises, the expropriation of land, and the nationalisation of banks and industries. Increased fiscal strain, particularly because of increased government expenditure, would accompany the shift to the left. High political volatility would result in major disruptions to business and an overall more adversarial relationship with private enterprises. It would discourage private investment, weaken the rand, and feed higher inflation.

Scenario 7: ANC 50+

Here, the ANC secures over 50% of the vote and forms a majority government. In this scenario, another 5 year term for the ANC would mean a continuation of poor service delivery, low economic growth, and feeble increases in employment. However, it would produce great policy continuity and government stability – essentially maintaining the status quo. The ANC would continue pursuing its policy agenda without needing coalition partners, and South Africa would continue its slow economic decline.

Scenario 8: ANC + MPC

This scenario involves the ANC forming a coalition with the multi-party charter (MPC), an alliance of opposition parties. The probability that the parties involved in the MPC could come to a joint agreement to partner with the ANC is highly unlikely. However, should such a coalition take government, high levels of political volatility should be anticipated as the points of difference between the ANC and the MPC parties are considerable.

Scenario 9: ANC + EFF + MK

Another low-probability scenario involves a coalition between the ANC, the EFF, and MK. An ANC-EFF-MK coalition would create a highly unpredictable and contentious political environment, with potential for major disruptions and challenges in both government and business operation. The ANC would have to make many concessions to bring its two disruptive partners on board. The relationship would be fraught with tensions and unlikely to last a full term.

Scenario 10: DA minority government

It is unlikely but not inconceivable that the DA, despite securing fewer votes than the ANC, could find itself in government. During voting in the National Assembly, disruptors such as the EFF and MK could decide to put their support behind the DA’s candidate for president to spite the ANC and discomfit the DA. Once elected, the DA president would then form a government by appointing members of parliament to the cabinet – conceivably all DA members. But passing legislation and budgets would require building a majority each time, and the government would be at constant risk of being ousted through a vote of no confidence. Such a scenario would result in high volatility and little policy change because the government would not last long enough to make its mark.

Scenario 11: MPC + MK

Another highly unlikely scenario entails the Multi Party Charter (MPC) assembling a majority with MK to form a government. The numbers for this are just barely conceivable – the scenario would require the MPC to get over 35% of the vote and MK, over 15%. Such a coalition government would introduce enormous volatility because aligning the MPC parties with each other is challenging enough before even adding a disruptive element such as MK into the mix. The distaste among the MPC members for former President Zuma may also be too great to make this an option.

Scenario 12: MPC government

The prospect that the MPC members would obtain a sufficient share of the vote to form a government outright – the basis of the MPC pact – must be considered fanciful at this stage.

Conclusion

As has been the case on local level, South Africa is entering an era of both provincial and national coalitions, likely characterised by volatile politics and the possibility of governments not serving full terms. The political class is increasingly preoccupied with its internal dynamics, leaving more space for non-state actors to play an increasingly important role.

As the bargaining power of the state diminishes, businesses and civil society will likely become the primary anchors of stability. This shift will lead to involuntary decentralisation, with local and provincial politics gaining greater importance. However, this period of instability brings the potential risk of populism, which could drive a departure from sound monetary and fiscal policies.

As the fiscal situation becomes more challenging, taxpayers may feel more pressure, and the government might resort to increasing debt or even seizing assets to cover shortfalls. In this context, civil society organisations and the business sector will play a critical role in providing stability and supporting the nation’s economic health in turbulent times.

Dr John Endres is CEO of the IRR, and Anlu Keeve is a researcher at the IRR

https://www.politicsweb.co.za/opinion/mapping-south-africas-postelection-space

LETTER | Rethinking BEE premiums could unlock billions for growth - Business Day

Feb 19, 2026

LETTER | Rethinking BEE premiums could unlock billions for growth - Business Day

Feb 19, 2026

IRR’s 2026 Budget tips for Minister Godongwana

Feb 19, 2026

IRR’s 2026 Budget tips for Minister Godongwana

Feb 19, 2026

Corruption-busting must begin with next week’s Budget – IRR

Feb 18, 2026

Corruption-busting must begin with next week’s Budget – IRR

Feb 18, 2026

Hold Ramaphosa to account for his SONA admissions of failure, IRR urges MPs

Feb 17, 2026

Hold Ramaphosa to account for his SONA admissions of failure, IRR urges MPs

Feb 17, 2026

Corrigan pt. II: FMD crisis — How did we get to this point? - Biznews

Feb 16, 2026

Corrigan pt. II: FMD crisis — How did we get to this point? - Biznews

Feb 16, 2026

LETTER | Rethinking BEE premiums could unlock billions for growth - Business Day

Feb 19, 2026

LETTER | Rethinking BEE premiums could unlock billions for growth - Business Day

Feb 19, 2026

IRR’s 2026 Budget tips for Minister Godongwana

Feb 19, 2026

IRR’s 2026 Budget tips for Minister Godongwana

Feb 19, 2026

Corruption-busting must begin with next week’s Budget – IRR

Feb 18, 2026

Corruption-busting must begin with next week’s Budget – IRR

Feb 18, 2026

Hold Ramaphosa to account for his SONA admissions of failure, IRR urges MPs

Feb 17, 2026

Hold Ramaphosa to account for his SONA admissions of failure, IRR urges MPs

Feb 17, 2026

Corrigan pt. II: FMD crisis — How did we get to this point? - Biznews

Feb 16, 2026

Corrigan pt. II: FMD crisis — How did we get to this point? - Biznews

Feb 16, 2026