Behind the common terminology used in economic analysis lies a sum of telling truths about the state of the nation.

This piece gives a summary of the seven most critical indicators of our fortunes as a country, and, potentially, of our future.

Far from being merely abstract concepts meaningful chiefly to economists, these indicators have an impact that is felt in bread-and-butter terms in millions of households across the country.

Gross domestic product (GDP)

GDP is the total monetary value of all the finished goods and services produced within a country's borders in a year.

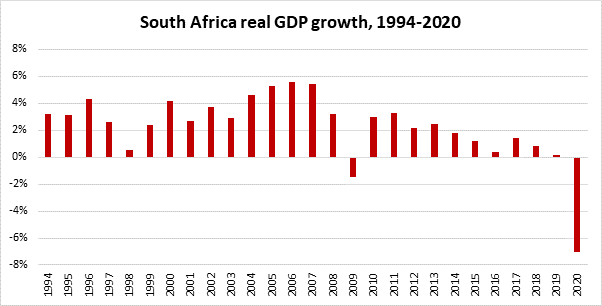

Source: South Africa Reserve Bank (SARB)

South Africa’s GDP at the end of 2020 was about R5.4 trillion. Taking into account the effects of inflation, the South African economy is now about the same size as it was in 2012.

GDP is a very important measure of the economic health of a country. A rising GDP indicates rising prosperity, with all the societal benefits that flow from it – as a rule, for example, people in wealthier countries are healthier, happier, better-educated and benefit from a cleaner environment.

In South Africa, high levels of GDP growth were achieved between 1994 and 2007, in the early years of ANC government, under the leadership of Nelson Mandela and Thabo Mbeki. The high point was reached between 2004 and 2007, when GDP growth rates averaged 5% per year. This improved living conditions for South Africans across all racial groups. The number of people employed doubled in a matter of ten years, access to housing, water and electricity increased by levels of 200%. During this time South Africa had a fiscally prudent government and liberalised markets, while the country benefited from improved access to global markets and rising commodity prices.

Since the financial crisis of 2007/8, the South African economy under the administrations led by Jacob Zuma and Cyril Ramaphosa has fared poorly. Economic freedom has declined as state interventionism has increased. The growing role of the state has also opened up increasing opportunities for corruption and self-enrichment, which members of the ANC administration and its associates have made liberal use of and which have imposed a heavy drag on the economy.

GDP per capita

Gross domestic product per capita is a measure that illustrates a country's economic output per person. It is calculated by dividing the GDP of a country by its population.

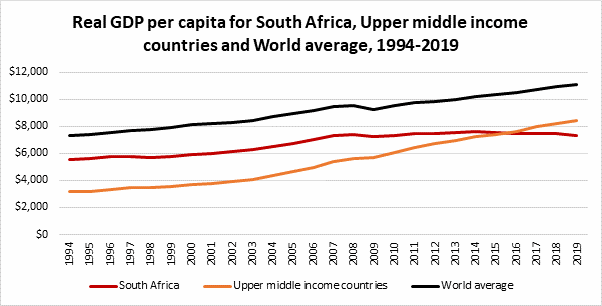

Source: World Bank

When taking into account the changes in GDP per capita, which reflect both population growth and economic growth, we can compare South Africa’s performance to upper middle-income economies and the world average. South Africa grew at the same pace as the rest of the world from 1994 to 2007. This means that, as the world got wealthier, South Africa followed suit. The country even outperformed upper middle-income countries in the same period. However, it began to lag behind the world after 2009 and lost its position as a leading country when compared to upper-middle income countries under the leadership of Jacob Zuma in 2016.

Labour absorption rate

The labour absorption rate is the number of people who are employed as a proportion of the working-age population (age group 15-64). It measures the employment rate of South Africa.

South Africa’s employment rate currently stands near 40%, which is just above half of emerging market rates of 60% and far behind that of developed markets of 70%. This is a consequence of the country’s labour policies, such as the minimum wage, which act as a barrier to new employment. To bring our employment rate up to where it should be – 60% – would require bringing a million unemployed people into employment every year for 10 years.

Gross Fixed Capital Formation (GFCF)

Gross Fixed Capital Formation measures investment as the increase in fixed capital such as plant, machinery and equipment purchases. This gives us an indication of whether there has been an increase or decrease in investment in South Africa.

From 1994 to 2007, South Africa’s Gross Fixed Capital Formation increased from 16% to 24% as a proportion of GDP. Thereafter it declined from 24% to 16% from 2008 to 2020. If GDP is the heart of the economy, then investment is its lifeblood. Investment funding, both foreign and domestic, is a vital part of a growing economy. It enables entrepreneurs to expand operations, create new ventures and maintain the value of their existing investments. An increase in investment leads to more businesses being started, which leads to more people being employed. To have high levels of investment, there need to be strong institutions that incentivise investors to invest in a country, such as strong property rights, independent institutions and the rule of law.

These are the institutions that the ANC is fundamentally trying to weaken through policies such as expropriation of property without compensation. This represents a risk to investors and entrepreneurs that they cannot bear; therefore entrepreneurs stop improving their businesses and limit expansion, which impacts negatively on the country’s employment.

Fiscal deficit

A fiscal deficit is the difference between a government’s revenue and its expenditure. This provides a good measure of whether a government is spending within its means or going into debt.

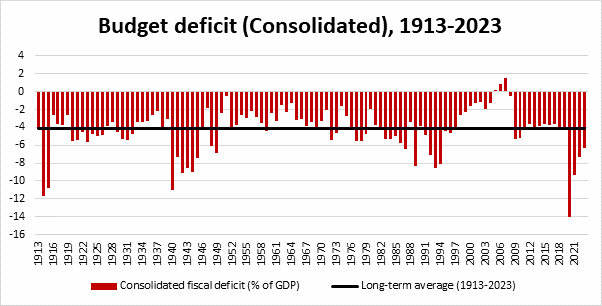

Source: National treasury, Bureau of economic research (BER)

In 2020, South Africa had a fiscal deficit of 14% of GDP. This figure is projected to decline to 9.3% in 2021 and 7.3% in 2022. South Africa’s fiscal deficit of 2020 is four times greater than what has traditionally been considered to be a large deficit, namely 3%.

The size of the government weighs heavily on South Africa’s society and economy. Countries with a limited government tend to outperform those with a massive government. This is mainly due to a huge state being an anchor on growth and the improvement of wellbeing in society. Fiscal prudence is when a state spends less than it receives in revenue. Unfortunately, this has been long been forgotten in South Africa.

The ANC is currently running deficits seen only three times before in South Africa’s history: during the First World War, the Second World War and the final years of Apartheid. Deficits are financed through borrowing, which adds to the country’s debt. This borrowing needs to be paid back in future, with interest. An excessive amount of borrowing will be a burden on future generations.

Gross government debt to GDP

The debt-to-GDP ratio is a metric comparing a country's public debt to its gross domestic product (GDP). By comparing what a country owes with what it produces, the debt-to-GDP ratio reliably indicates whether a country is able to pay back its debts.

There was a period when South Africa ran a fiscal surplus and reduced government debt by half. This was under the leadership of Thabo Mbeki. Government debt as a proportion of the size of the economy declined from 43% in 1994 to 26% in 2007. Thereafter, there was been a significant increase in government debt under Jacob Zuma, when Pravin Gordhan was the finance minister, with debt levels doubling and GDP stagnating.

The fiscus deteriorated because state expenditure – including above-inflation pay increases for civil servants and bailouts for loss-making state-owned enterprises – accelerated faster than state revenue. This left the country vulnerable to external shocks such as the Covid-19 pandemic of 2020. Debt levels in 2020 increased by 20% – a risk to the country, as the ANC may seek measures of increased taxation, asset seizure and possibly money-printing to pay off this debt.

Inflation

Inflation is the decline of purchasing power of a currency over a period of time – in other words, how much less you can buy with a R100 note each year. Inflation is measured by tracking the increase in consumer prices.

If the ANC goes in the direction of printing money, then the route it would take would be the weakening of the independence of the South African Reserve Bank (SARB). The result of this would be periods of massive inflation, also known as hyperinflation, when price increases are excessive and out of control, typically increasing by over 50% per month. Countries such as Zimbabwe and Venezuela are prime examples of the high cost hyperinflation inflicts on society.

South Africa has every opportunity to change direction. All that needs to occur is a shift in the mindset of the governing party from a state-driven ideology to favouring limited government and elevating the interests of South African citizens above its own interests.